Frontdoor, Inc. (FTDR) is a company dedicated to simplifying homeownership through its innovative home service plans. Their primary focus is on providing homeowners with peace of mind by covering the repair and maintenance of essential systems and appliances.

With a range of home warranty plans, they ensure that if something goes wrong—be it the heating system in the middle of winter or a malfunctioning dishwasher—homeowners can quickly access reliable service providers. The user-friendly app allows customers to manage service requests with ease, check coverage details, and get assistance right from their smartphones, making the whole process hassle-free.

The key products and services offered by Frontdoor include comprehensive home warranty plans that cover vital home systems, such as plumbing, electrical, and HVAC systems, along with kitchen appliances. Customers can also customize their coverage with various add-on services tailored to their specific needs. This flexibility sets Frontdoor apart from competitors and allows homeowners to choose plans that suit their unique circumstances. The company’s commitment to delivering high-quality service and customer satisfaction has fostered a loyal client base.

Growth for Frontdoor is driven by several factors, including the increasing number of homeowners who seek reliable maintenance solutions in a rapidly expanding housing market. As more people invest in homes, the demand for protection against unexpected repair costs rises. Frontdoor’s emphasis on leveraging technology enhances the overall customer experience, ensuring faster service and seamless communication. With a vast network of vetted service providers, the company guarantees quality assistance whenever it’s needed, which is crucial in building trust and maintaining their positive reputation in the industry.

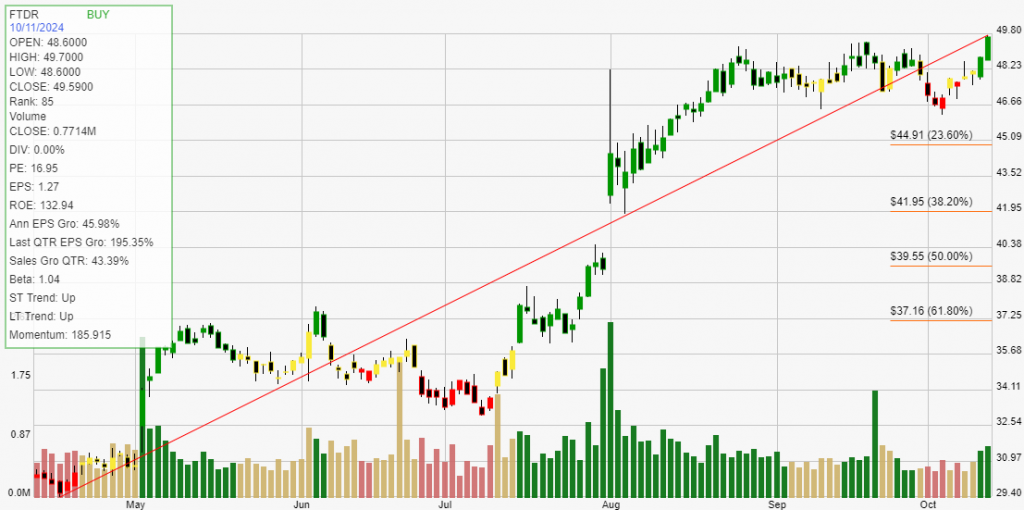

Click The Image For Current Live Chart

Backtesting a stock can provide investors with critical statistical data. These results give you an informed perspective on how a stock trades within your chosen buying and selling method of analysis. The definition of trade expectancy is defined as: trade expectancy = (probability of win * average win) – (probability of loss * average loss). If the calculation returns a positive number, a trader should make money over time.

The average percentage gained on positive, money making trades was 9.32%. While the average percent loss on money losing trades was 3.32%.

Trade expectancy includes both winners and losers. Trade expectancy is displayed as a percentage. This backtest displays the dollar value, percentage, annual trade expectancy, and annual percent. Annual expectancy is the trade expectancy percentage multiplied by the number of trades per year.

The Trade expectancy % for FTDR over the past year is 3%. The number of trades generated per year was 5 giving an Annual Trade Expectancy of 14.98%

The average days in a trade is 39 and the average days between trades is 35.

With any method of analysis that uses past performance, it can be said that past performance is not indication of future performance. What is does provide is a probabilistic look at a stock’s price activity characteristics over time.