AudioEye, Inc. (AEYE) is a technology company that specializes in digital accessibility solutions. Founded in 2005, AudioEye focuses on making digital content accessible to all users, including those with disabilities, through its comprehensive suite of tools and services. The company’s mission is to ensure that websites and applications comply with accessibility standards, such as the Web Content Accessibility Guidelines (WCAG), thereby creating an inclusive online experience for everyone.

AudioEye’s primary products include its patented technology platform, which automates the process of identifying and remediating accessibility issues on websites. The platform offers a range of features, including automated scanning, manual remediation support, and ongoing monitoring to ensure compliance with accessibility standards. Additionally, AudioEye provides consulting services to help organizations develop and implement effective accessibility strategies tailored to their specific needs.

The main drivers of growth for AudioEye include the increasing awareness of digital accessibility and the growing demand for compliance with accessibility regulations. As more businesses recognize the importance of providing accessible digital experiences, AudioEye is well-positioned to capture market opportunities. The company’s focus on innovation, customer education, and partnerships with organizations seeking to enhance their accessibility efforts further supports its growth trajectory. Additionally, the ongoing push for inclusivity in the digital space presents significant opportunities for AudioEye to expand its reach and impact. Learn more at AudioEye, Inc..

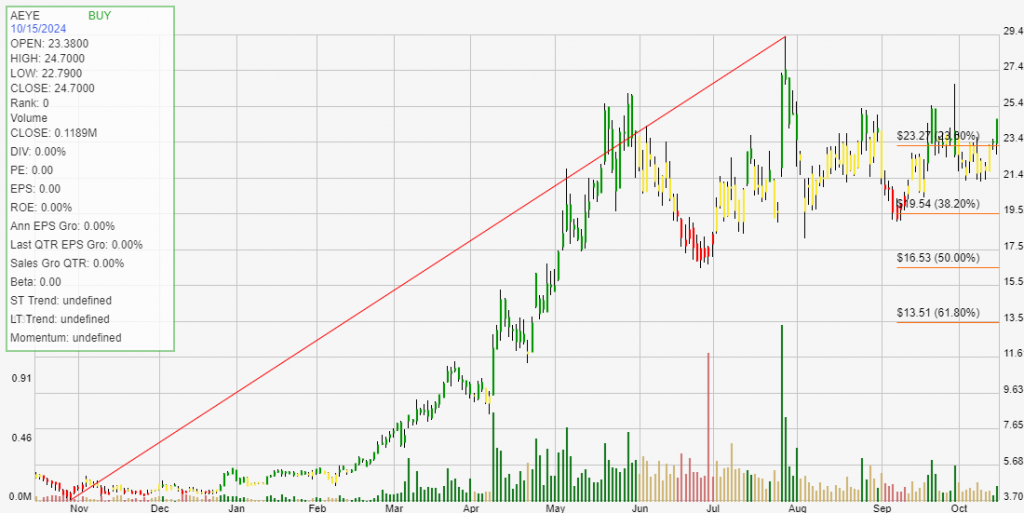

Click The Image For Current Live Chart

Backtesting a stock can provide investors with critical statistical data. These results give you an informed perspective on how a stock trades within your chosen buying and selling method of analysis. The definition of trade expectancy is defined as: trade expectancy = (probability of win * average win) – (probability of loss * average loss). If the calculation returns a positive number, a trader should make money over time.

The average percentage gained on positive, money making trades was 166.41%. While the average percent loss on money losing trades was 9.52%.

Trade expectancy includes both winners and losers. Trade expectancy is displayed as a percentage. This backtest displays the dollar value, percentage, annual trade expectancy, and annual percent. Annual expectancy is the trade expectancy percentage multiplied by the number of trades per year.

The Trade expectancy % for AEYE over the past year is 78.44%. The number of trades generated per year was 4 giving an Annual Trade Expectancy of 313.77%

The average days in a trade is 77 and the average days between trades is 22.

With any method of analysis that uses past performance, it can be said that past performance is not indication of future performance. What is does provide is a probabilistic look at a stock’s price activity characteristics over time.