Blackstone Inc. (NYSE: BX) is a leading global alternative asset manager headquartered in New York City, overseeing more than $1 trillion in assets across multiple investment strategies, including private equity, real estate, credit, and hedge funds. Founded in 1985, Blackstone has established itself as a premier investment firm, delivering strong returns and supporting a range of industries worldwide. The company’s diverse portfolio and strategic initiatives position it as a central player in alternative investments globally.

Blackstone’s key business segments include a broad array of investment products and services. In Private Equity, Blackstone partners with management teams to acquire and build companies with substantial growth potential, leveraging operational enhancements to create long-term value. In Real Estate, Blackstone holds a prominent position with investments in commercial, residential, and logistics properties, using value-add strategies to maximize asset performance. Its Credit and Insurance division provides private credit, leveraged loans, and distressed debt solutions, while the insurance segment delivers strategic support and capital. The Hedge Fund Solutions segment offers a diversified portfolio of hedge fund strategies, aiming for consistent, risk-adjusted returns.

The main drivers of Blackstone’s growth include strategic acquisitions, diversified investment strategies, and a focus on high-growth sectors. The firm actively pursues acquisitions to expand its global reach, such as recent investments in retail and telecommunications infrastructure. By diversifying across private equity, real estate, credit, and hedge funds, Blackstone capitalizes on a range of market opportunities, effectively managing risk. Its commitment to investing in emerging areas like artificial intelligence and technology infrastructure aligns Blackstone with economic trends and maintains its competitive advantage in the alternative asset management space.

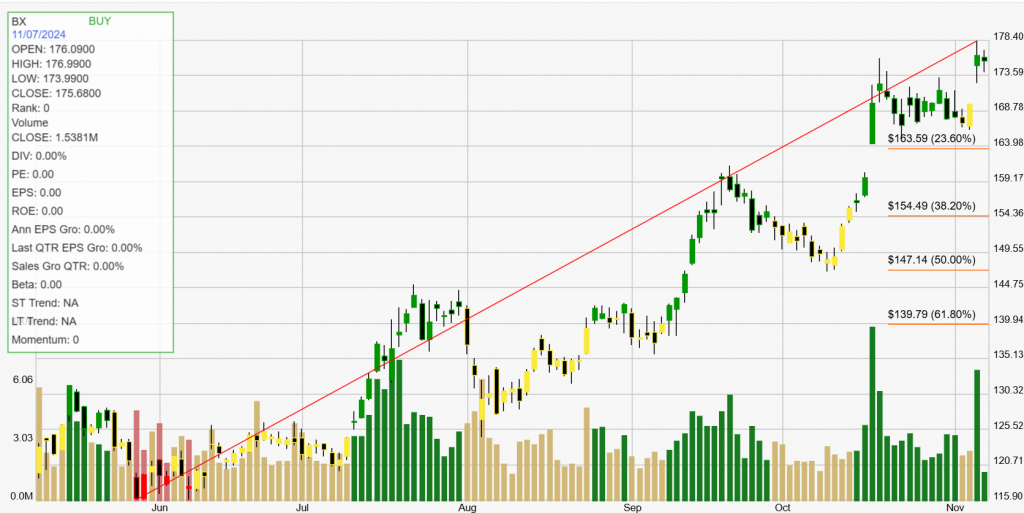

Click The Image For Current Live Chart