Vistra Corp. (VST) is a Texas-based energy company that operates a diverse portfolio of power generation and retail electricity businesses across the United States. Vistra’s power generation assets include both traditional and renewable energy sources, such as natural gas, coal, solar, and battery storage.

Through its retail brands, like TXU Energy, Vistra provides electricity solutions to residential, commercial, and industrial customers. A major player in the energy sector, Vistra is focused on advancing clean energy initiatives and reducing its carbon footprint by expanding its renewable energy projects and battery storage capacity.

A key growth driver for Vistra is the growing demand for sustainable energy solutions as companies and consumers look to reduce their environmental impact. Vistra has invested significantly in solar power and energy storage, positioning itself as a leader in the transition to cleaner energy. Additionally, the company’s retail electricity segment provides stable revenue and supports its growth initiatives by delivering reliable and flexible power options tailored to customers’ needs. With a balanced approach to energy generation and a commitment to sustainability, Vistra is helping shape the future of energy in a way that meets both environmental and consumer needs.

For more information on Vistra Corp. and its energy solutions, visit their main website.

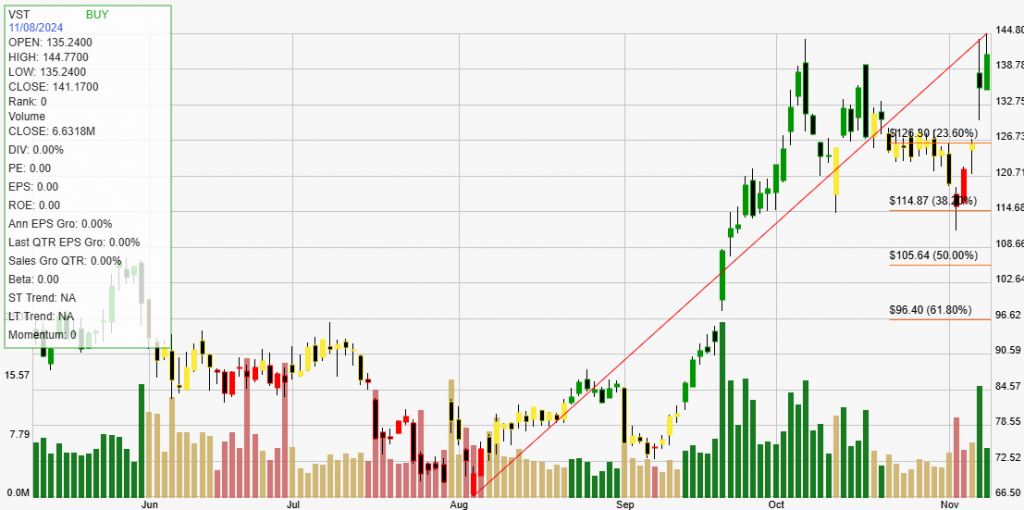

Click The Image For Current Live Chart