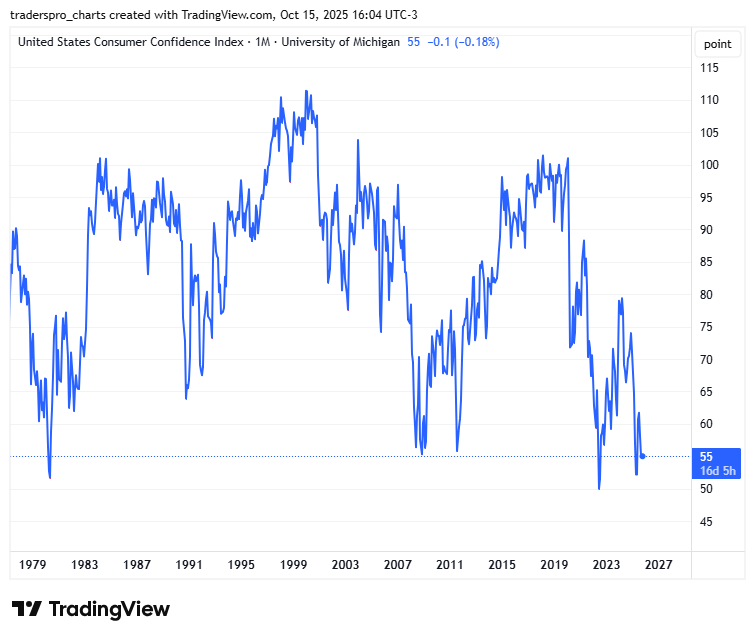

University of Michigan Consumer Sentiment Index—one of the longest-running and most-watched gauges of how U.S. households feel about the economy.

It began in the late 1940s, designed by economist George Katona to measure the psychological side of consumption—expectations, purchasing plans, job security, and attitudes about inflation. In modern macro analysis, it’s often used as a leading indicator for consumer spending, since sentiment usually softens before actual consumption slows.

A quick history of the index

- 1970s stagflation: Confidence plunged below 60 during oil shocks and runaway inflation.

- Early 1980s recession: Record lows as interest rates hit double digits.

- 1990s boom: Consumer sentiment soared above 100—dot-com optimism and rising wages.

- 2008 crisis: Collapsed again below 60 as credit markets froze.

- Post-COVID 2020s: Hit all-time lows (near 50) in 2022 due to inflation spikes, even though jobs were plentiful.

Why it’s near 60-year lows today despite “strong” data

This is the paradox of the current cycle—the macro stats look solid, but the micro experience feels fragile:

- Inflation’s lingering bite: Prices stopped rising as fast, but they didn’t fall. Households are still paying 20–25% more for essentials than in 2019, and wages haven’t fully caught up in real terms.

- High interest costs: Mortgages, car loans, and credit cards now feel twice as expensive. Consumers see the Fed’s policy success in theory—but feel the monthly squeeze.

- Housing affordability shock: Home prices remain near record highs, locking out new buyers and freezing mobility. That alone dampens sentiment.

- Debt fatigue: Credit-card balances and auto delinquencies are quietly climbing. People may be employed, but they’re stretched.

- Uneven prosperity: Stock portfolios, corporate profits, and AI-driven industries look great, but that wealth feels distant to most workers. Confidence readings often lag when the median household sees headlines about record markets but feels poorer in daily life.

- Mistrust and uncertainty: Political polarization, media noise, and mixed messaging from policymakers erode confidence even when objective metrics improve. Sentiment indexes capture emotion, not GDP prints.

Why it matters

Historically, low sentiment doesn’t guarantee recession, but it often precedes slower spending and market volatility. When consumers lose optimism while employment and output remain high, it usually signals a turning point—either inflation fatigue gives way to disinflation and relief, or spending cracks appear.

In plain terms: the average American believes the economy “looks good on paper but not for me.” That disconnect is why sentiment is nearing multi-decade lows even as the S&P 500 and job numbers shine.

It could become a problem. THE Problem.

Trade Of The Day

The stock trade of the day provides you a leading stock that is trending in the current market environment.

[Get The Trade]

Market Trends

Understanding the overall market trend is the foundation of smart trading. Why? Because 85% of all stocks tend to move in the same direction as the broader market.

[Get the Report]

GET OUR FREE DAILY STOCK PICK NEWSLETTER