STEP 1

The Market Trend

Once you know the major market trend. The majority of the money-making battle is over, Because 85% of the stocks move in the direction in which the market is trending.

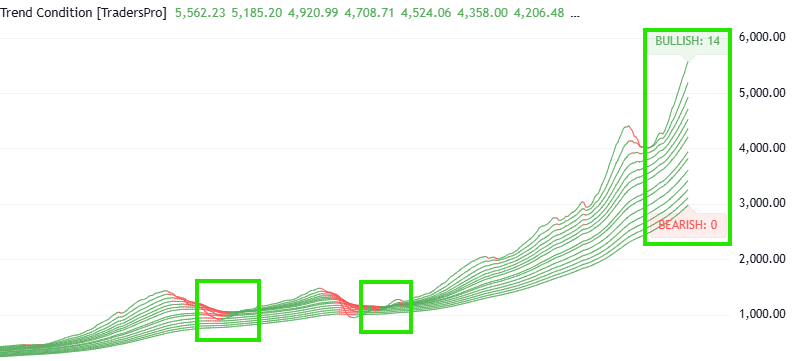

You can see that TradersPro clearly and accurately identifies the trend of the long-term market. This is the first place you will start to identify the market trend.

- What direction is the stock market moving? Up or down?

- How long has this trend been in place?

- Is the Long-Term trend too extended to make a trading decision?

You can determine this by checking the Trend Condition indicator of TradersPro each day. This is a chart of the past 20 years. You can see how trends expand and compress over time.

How long has this trend been in place? Is the Long-Term trend too extended to make a trading decision?

The Trend Condition indicator for TradersPro provides traders the ability to see if the trend is compressed or expanded. It’s the rythm of the market. The market expands and contracts the trend over and over.

Identify Strong Sectors

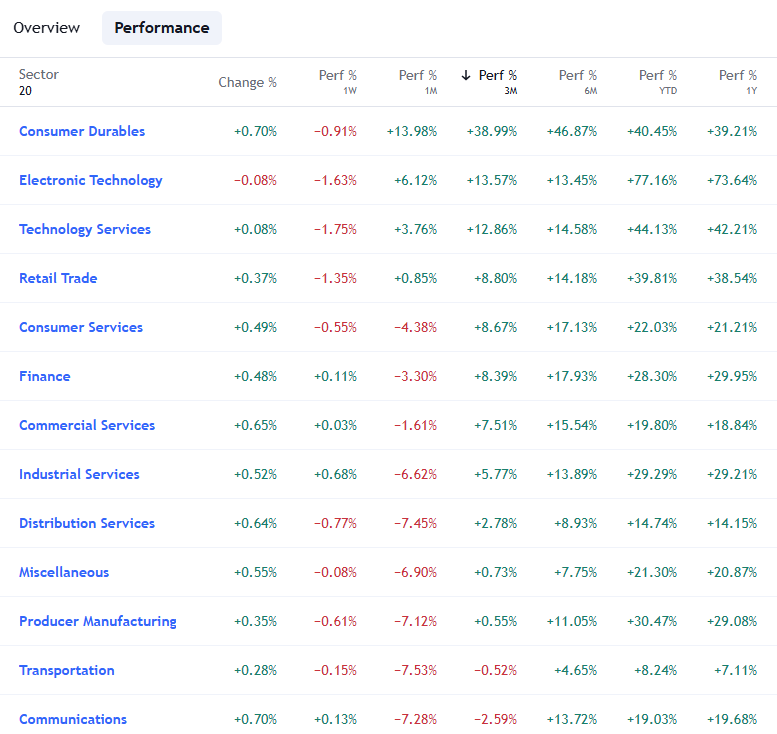

Now that you know the overall market trend direction, we can look for what sectors are performing best. Find sector leadership, then screen for individual stocks in that sector.

In the current market conditions consumer durables is the leading sector. This is based on performance of the trend of the entire sector.

The strongest sectors and the strongest stocks will start to float to the top no matter what the market is doing.

There will be sectors that do very well even if the stock market as a whole is going down. There are always new trends and new technologys that are introduced to the market all the time.

Stocks like MTEK which is up over 200% since its recent bullish trend shift in December.

STEP 3

Find Strong Stocks

In strong bull markets leading stocks can attract large instiutional money flow. The kind of money flow that moves stocks in a significant way.

STEP 4

Take Action To Buy

In Step 4 we are ready to take action. In bullish market conditions, when the uptrend is new or expanding from a compressed Trend Condition, its time to excecute a trade. Traders can determine the risk they are willing to take on the stock trade by using position size (the number of shares of the stock) and a stop loss (the price you get out if the trend doesn’t move your way).

In the example of GILT, the buy signal would be after the most recent hold signal. This is a sytematic trade setup. This means you can screen for the same trade setups over and over again.

Trades can be entered on a contiuation trade. This is considered a trend shift, when a stock moved from yellow (trend transition) to green (bullish trend).

Make trading and investing fun again. Practice this process a few times by looking for these conditions and building a portfolio of stocks. It takes 5 Mins or less each day to consider, review and put into action these four simple steps to pick winning stocks.