Hurricane Dorian just barreled its way through the Bahamas earlier this week, and estimates of the damage have already skyrocketed to dramatic levels. A new Bloomberg report cited risk modeler and insurance firm Karen Clark & Co., which said that damage to commercial, residential, and industrial properties as well as business-interruption expenses could total $7 billion. That nearly wipes out the country’s $9 billion economy without even accounting for vehicle losses or infrastructure damage.

The June-November period otherwise known as “hurricane season” can be extremely lethal to national economies. The 2017 Atlantic hurricane season was estimated to be the costliest season on record, with damages totaling $360 billion. Hurricane Harvey alone — which landed in late August 2017 and decimated Houston and most of Southeast Texas — racked up $125 billion in total damages, tying with Hurricane Katrina in 2005.

While the unimaginable devastation may make seeking investing opportunities seem callous, savvy market participants should always identify them whenever they can. Many companies in charge of restoring the affected areas can quickly become backdoor profit plays, particularly construction materials companies poised to benefit the most from the cleanup efforts. They’re the ones reaping enormous contracts from the federal government when the clouds clear and people get a good look at what needs to be done.

For instance, on Sept. 14, 2017, shortly after Harvey and Irma made landfall, the Federal Procurement Data System (FPDS) reported nearly $614.3 million worth of contracts had been awarded to repair damage from the two hurricanes. Harvey and Irma both hit the United States within weeks of each other and cost an estimated $330 billion in damages combined. By the end of that year, the U.S. Government Accountability Office (GAO) reported that federal agencies allocated $5.6 billion worth of contracts to support recovery efforts from Harvey, Irma, and Maria.

The companies poised to land the biggest contracts – and return the most profits to investors – are usually the ones selling ready-mixed concrete and cement-related materials. After all, concrete and cement create roads, highways, and buildings, all considered the backbone of U.S. infrastructure. The concrete industry also has extreme economic importance, boasting more than half a million U.S. workers and $49 billion in annual payroll.

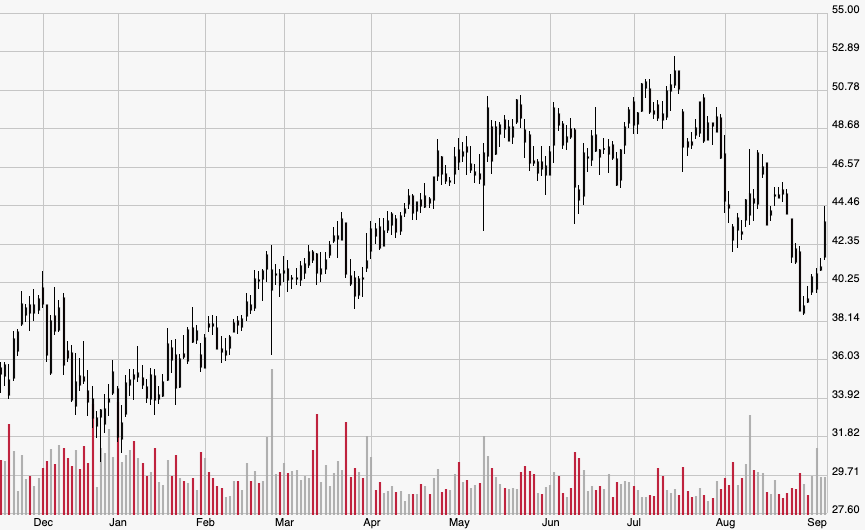

According to the Weather Channel’s official site, there are eight other storm systems besides Dorian currently in the Northern Hemisphere that are either named storms or areas that may soon become named storms. Investors looking for a solid and safe play before the next one makes U.S. landfall should consider U.S. Concrete Inc. (USCR), one of the U.S. construction industry’s biggest providers of concrete products with revenue of $367.5 million on 2.9 million tons of concrete volume in the second quarter.

Even better are the stock’s fundamentals, which already reflect some of the company’s increased demand. Based on current-year earnings per share (EPS) estimates from Thomson Reuters analysts, USCR’s P/E ratio is 16.2, far lower than the trailing P/E ratio (covering the pre-hurricane period) of 45.95, meaning analysts are bullish on the stock and expect bigger earnings by the end of the year.

Furthermore, if we look at next year’s estimates from the same analysts, the P/E ratio drops to 11.97. The only way to get that low P/E ratio is for next year’s profits to grow, which investors should expect while collecting handsome returns in the form of share-price gains.